In my opinion this can work out. In the current market environment efficiency is the key. If you are one of the most efficient miners, you will stay in the market while others have to turn their machines off. We are clearly moving away from an exponential growth scenario where you had to ROI within 2-3 months (or get screwed by the exponential function) to a more sustainable scenario where mining is a long term investment.

The only negative scenarios that can happen are:

1) Mass deployment of machines with same electricity efficiency class and cheaper or free electricity. This is unlikely to happen. Those who have cheap electricity available will already make a profit from it. I am not talking about 100 kW free electricity here, but about amounts like 20-50 MW that make a difference.

2) Significantly more efficient ASICs are available. This could theoretically happen, however: (i) making major improvements over current design gets gradually more difficult (and expensive!) (ii) investments in chips would have been taken place at a time where Bitcoin price was under massive pressure (iii) I am not aware of any next generation tape outs (a friend has good contact to several manufacturers and he did not hear about next generation chips).

I have purchased also some sha256 hashrate recently mining Unobtanium coin (knowing that it is a long-term investment).

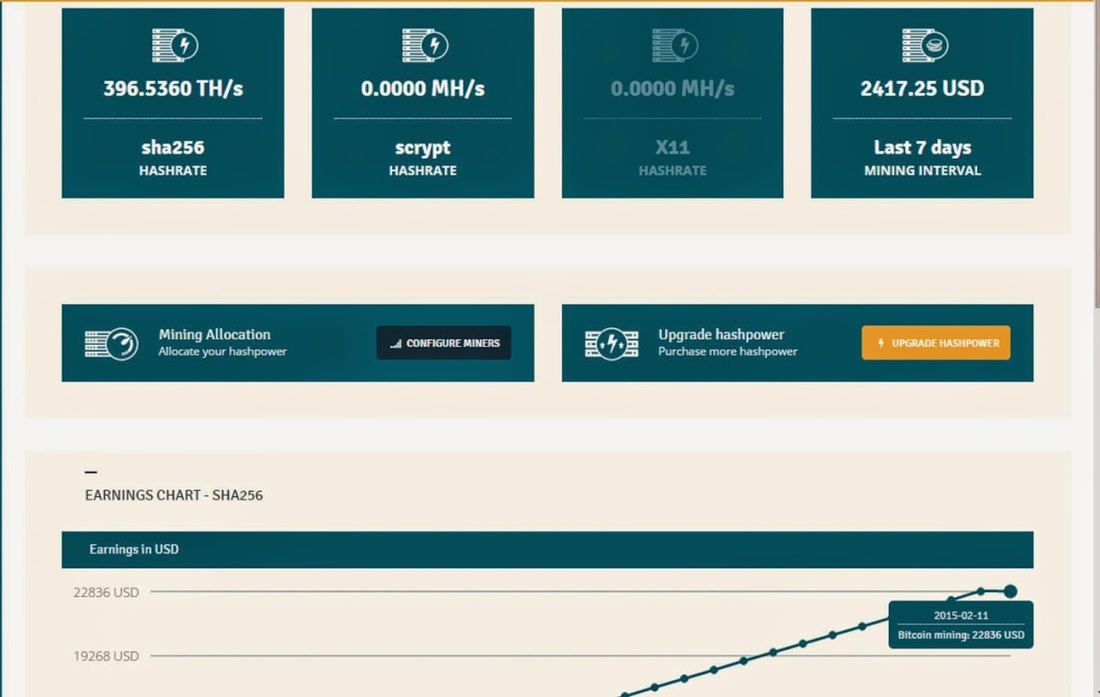

On the foto a screenshot from a big invester whit a sick amount of hashing power, total cost arround 750 Bitcoins!

RSS Feed

RSS Feed